Agricultural Tractors Market Size To Expand Significantly At 6.8% CAGR By 2030, Based on High Demand For Compact Tractors in Small Farms | Grand View Research, Inc.

The global agricultural tractors market demand was valued at 2,765.3 thousand units in 2021 and is expected to reach 4,968 thousand units by 2030, expanding at a CAGR of 6.8% during the forecast period,

The surge in demand for compact tractors in small farms and technological advancements, such as integrating telematics with agricultural tractors, are expected to drive market growth over the forecast period. In addition, the rapid adoption of mechanization in the agriculture industry is likely to bode well for the market growth over the next eight years. Furthermore, farm laborers’ migration towards cities creating a shortage of laborers is anticipated to drive the market growth. The outbreak of COVID-19 hampered the product demand owing to the temporary suspension of production and supply chain disruption.

Gather more insights about the market drivers, restrains and growth of the Global Agricultural Tractors Market

However, in H1 2021, the demand for tractors bounced back significantly with double-digit growth in major economies, such as the U.S, Canada, the U.K., Germany, China, and India. Also, strong crop production in these markets, along with the need to replace aging equipment, increased product sales in H1 2021. However, a sudden increase in demand led to lower inventory levels of tractors in H2 2021, a trend expected to continue over the next few quarters of 2022. In 2022, OEMs are presumed to increase the agricultural tractors prices from 4% to 22%, which is anticipated to further slowdown the market growth. It is attributed to low inventory levels of tractors experienced by dealers.

Also, OEMs are currently experiencing a shortage of semiconductors coupled with supply chain disruptions and market uncertainty due to the growing COVID-19 cases, which may delay production. Furthermore, a hike in steel and aluminum prices is expected to increase tractors prices, which is further anticipated to hinder market growth over the next few quarters. Favorable government policies are likely to boost market growth over the forecast period. For instance, on September 15, 2021, the U.S. Department of Agriculture (USDA) introduced a Precision Agriculture Loan (PAL) Act to allow farmers and ranchers to avail loans to purchase precision agriculture equipment.

Similarly, the imposition of The U.K. Agriculture Act 2020 and the Canadian Agricultural Loans Act (CALA) are likely to favor the product demand over the forecast period. Such initiatives are expected to fuel the market growth over the forecast period. Technological advancements in agricultural tractors are also expected to bode well for the market growth over the forecast period. For instance, the rising popularity of autonomous and electric tractors is projected to increase productivity and efficiency in farming.

Key vendors in this space, such as Deere & Company, CLAAS KGaAmbH Escorts Ltd., SOLECTRAC, and Monarch, have commercially launched concepts for their autonomous and electric tractors. For example, in December 2020, MONARCH TRACTOR announced the launch of its electric tractor integrated with autonomous, machine learning, and data analysis features. The launched tractor envisages farmers in improving operational efficiency, enhancing labor productivity and safety, and increasing yields.

Agricultural Tractors Market Segmentation

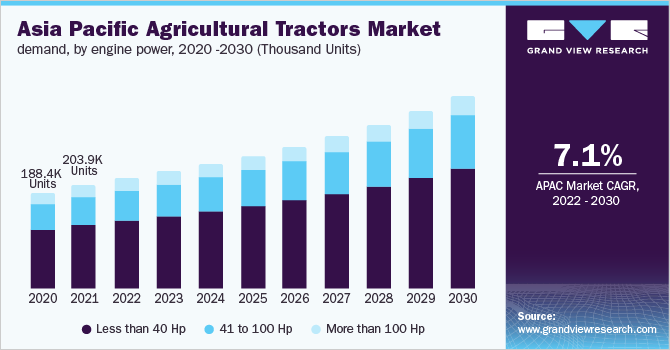

Based on the Engine Power Insights, the market is segmented into Less than 40 HP, 41 to 100 HP, More than 100 HP

- The 40 HP to 100 HP segment is expected to register a significant CAGR during the forecast period. It is credited to a surge in demand for these tractors from developed markets, such as the U.S, Japan, and Germany.

- The high growth can be attributed to low cost, compact size, and greater convenience offered by less than 40HP tractors to perform all basic farming operations.

Based on the Driveline Insights, the market is segmented into 2WD, 4WD

- The 2WD segment accounted for more than 79.5% market share in terms of volume and the segment is also estimated to register the fastest growth rate over the forecast period.

Based on the Regional Insights the market is segmented into North America, Europe, Asia Pacific, Latin America & Middle East & Africa

- Asia Pacific led the global market with a volume share of more than 73.5% in 2021 and is estimated to grow further at the fastest CAGR over the forecast period retaining the dominant position.

- Europe is expected to grow at a moderate growth rate in terms of volume over the next few quarters in 2022. The growth is attributed to the increased demand for large farm tractors, particularly from Italy, Greece, and Lithuania.

Market Share Insights

- November 202: CNH Industrial N.V. signed a long-term agreement with Monarch Tractor, an AgTech company, to develop fully electrified autonomous tractors.

- August 2021: Deere and Company acquired Bear Flag Robotics, an AgTech company, for USD 250 million.

Key Companies Profile:

Some prominent players in the global agricultural tractors market include:

- AGCO Corp.

- CNH Industrial N.V.

- Deere & Company

- CLAAS KGaAmbH

- Escorts Ltd.

- International Tractors Ltd.

- YanmarCo., Ltd.

- KubotaCorp.

- Mahindra & Mahindra Ltd.

- Tractors and Farm Equipment Ltd.

Order a free sample PDF of the Agricultural Tractors Market Intelligence Study, published by Grand View Research.

About Grand View Research

Grand View Research is a full-time market research and consulting company registered in San Francisco, California. The company fully offers market reports, both customized and syndicates, based on intense data analysis. It also offers consulting services to business communities and academic institutions and helps them understand the global and business scenario to a significant extent. The company operates across multitude of domains such as Chemicals, Materials, Food and Beverages, Consumer Goods, Healthcare, and Information Technology to offer consulting services.

Web: www.grandviewresearch.com

Media Contact

Company Name: Grand View Research, Inc.

Contact Person: Sherry James, Corporate Sales Specialist – U.S.A.

Email: Send Email

Phone: 1888202951

Address:Grand View Research, Inc. 201 Spear Street 1100 San Francisco, CA 94105, United States

City: San Francisco

State: California

Country: United States

Website: https://www.grandviewresearch.com/industry-analysis/agricultural-tractors-market